(-‿-) Unknown, Unpopular, Underrated.

I have recently invested in my wikifolios, at FollowMyMoney and/or my private accounts the following shares:

Star Energy, $IGAS, ISIN #GB00BZ042C28

https://www.starenergygroupplc.com/investors/

All other currencies are in British pounds sterling!

The company

Star Energy Group plc (formerly IGAS) is an energy company based in the United Kingdom. The company is engaged in the onshore energy production, exploration, development and production of onshore oil and gas at its sites. The company operates various onshore oil and gas fields in the UK. The company is also active in the development and construction of geothermal energy.

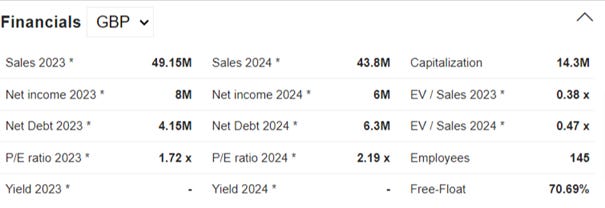

Financial data

According to MarketScreener, the financial data is as follows.

The market capitalization is only 14.3 Mio. Debt is around 4 Mio. Debt has been reduced by around 8 Mio since 2021. The price/earnings ratio is only 1.7 for 2023 and 2.2 for 2024. For 2024, MarketSreener's calculation shows earnings falling from 49.2m to 43.8m. To my knowledge, Star Energy is not hedged with regard to its oil, so the company can fully benefit from the recent price increase. Earnings should therefore rise in 2024.

The company has obtained financing to pay off the remainder of the old debt and to cover the drilling costs in the geothermal sector. This leaves the cash flow from the oil business so that it can be expanded and optimized.

The latest results

The half-year results for 2023 were as follows:

- Adjusted EBITDA of £9.4 million (June 30, 2022: £10.7 million)

- Revenue £23.8 million (June 30, 2022: £30.5 million)

- Operating costs of $40.3/boe (£32.8)/boe (June 30, 2022: $42.5 (£32.4)/boe)

- Reduction in net debt to £ 4.0 million (June 30, 2022: £ 9.7 million)

- Investments in the amount of £4.4 million.

- Tax loss carryforwards in the amount of £ 259 million (June 30, 2022: £ 263 million)

- Estimated energy profit levy based on H1 23 of approximately £0.9m payable in October 2024

The chart

As you can see from the chart, Star Energy is not a typical buy & hold stock.

The low of around 8 pence was reached in the coronavirus year 2020. It then moved sideways for a while. In 2022, the high was over 100 pence. The background to this is the confusion in British energy policy. Short-term Prime Minister Liz Truss (45 days) wanted to lift the ban on fracking in England. Star Energy (then still IGAS) would have benefited massively from this, as it had a number of potential fracking gas fields in its portfolio. There were no additional sales in the short term, but there was a lot of fantasy. In the period from August to October, a number of funds invested in Star Energy at high volumes. With the resignation of Liz Truss in October 2022, the share price quickly collapsed from over 100 pence to 25 pence.

For those who want to go deeper (in german):

resignation of liz truss - chaos in "britalia"

An adjusted operating profit from the core business of £16.1 million was achieved for the 2022 financial year. However, as the remaining fracking gas fields were written down by £ -30.0 million, there was a negative result for the year. The funds exited again and the share price crumbled to 7.4 pence by March 2024, although the operating profit from the core business in 2022 was higher than ever before. The next resistance is now at the current price of 11.64 pence.

The fundamental key figures (own calculations)

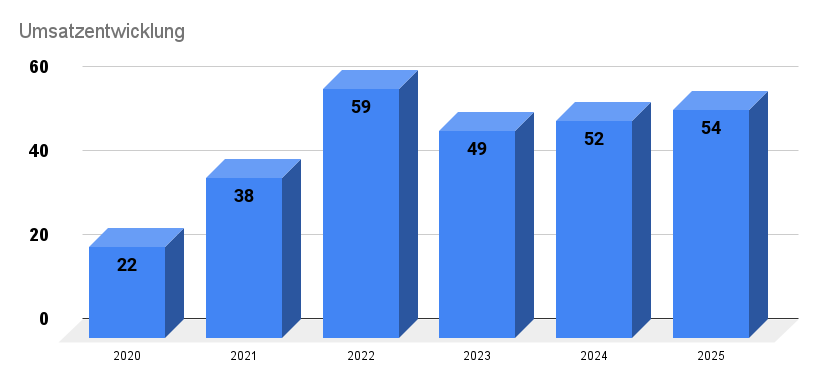

I expect sales to develop as follows:

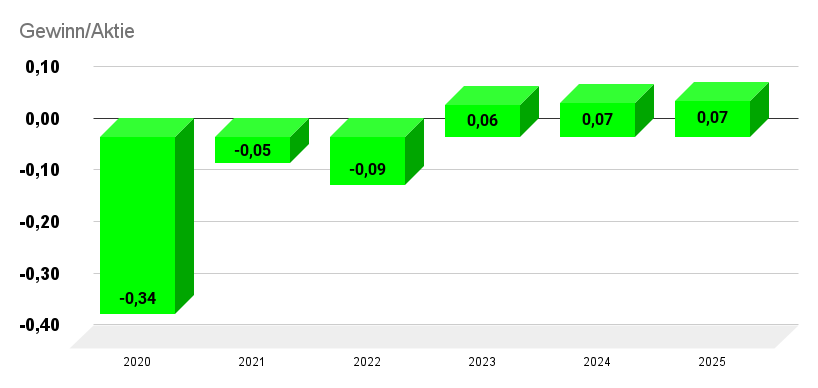

Earnings per share developed as follows:

Possible catalyst

Star Energy is a typical 3 x U share:

· Unknown

· Unpopular

· Undervalued.

As far as I know, there are currently no discussions on Twitter or Seeking Alpha and no analysts following the share. The 2023 annual results will be announced on 24.4.2024. I expect the story to become better known then.

My price target for the next 3 years is 75 Pence (+578%)

Since the spreads in Germany are high and the volume is low, you should definitely trade in London!

My investment style is a mixture of value/momentum investor. Based on the fundamental data (VALUE) and the share price performance of the last 52 weeks (MOMENTUM), the share is currently one of my TOP 25 shares. These are the stocks where I see the highest chances of strong price gains in the medium term (1-3 years). I also buy these stocks in my wikifolios and at FollowMyMoney .

"Speculative investments are like a tennis match: the key is to concentrate fully on the next ace instead of getting annoyed about the last double fault." A. Gerstenberger

Disclaimer / Exclusion of liability

All content is for information purposes only and does not constitute investment advice or a solicitation to buy or sell securities or other financial market instruments. Naturally, I endeavor to present the facts to the best of my knowledge and belief, but they may still be partially or completely incorrect.

I therefore accept no liability whatsoever for investment decisions that you make on the basis of the information presented here.

Conflict of interest: At the time of publication, the author of this publication holds shares/securities in the stocks/companies discussed here and intends to sell them depending on the market situation and could benefit in particular from increased trading liquidity. This represents a concrete and clear conflict of interest.