I recently bought/added the following shares in my wikifolios at FollowMyMoney and/or my private accounts:

Hydreight Technologies TSXV: NURS, OTCQB: HYDTF

ISIN # CA44877L1013

https://hydreight.com/investors/

Presentation of the company

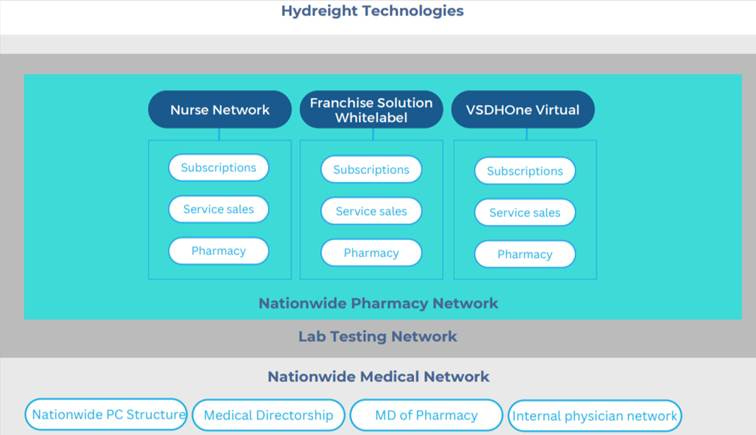

Hydreight Technologies Inc., founded in 2018 and based in Las Vegas, Nevada, is a Canadian company that operates a platform for mobile health and wellness services. The platform connects licensed healthcare professionals, including over 2,500 nurses and over 100 doctors, with patients to offer services such as infusion therapies, telemedicine, weight loss programs (e.g., GLP-1 therapies), and genetic testing directly at the patient's location – whether at home, in the office, or in a hotel. The company is active in all 50 US states and has a pharmacy network that ensures the supply of medical products.

Hydreight offers a fully integrated platform that includes tools for booking, billing, documentation, warehouse management and patient data management. This allows healthcare professionals to work independently or add mobile services to their existing practices. The platform, including the VSDHOne solution, supports telemedicine and e-commerce for healthcare providers.

Revenue:

The main sources of revenue come from fees for the services provided, including mobile infusion therapies, telemedicine, and other wellness services. In addition, the company generates revenue through its pharmacy network and potential partnerships.

Growth prospects:

Hydreight has shown impressive growth in recent years. Revenue increased from $3.276 million in 2022 to $16.04 million (GAAP) in 2024, an increase of 39%. For the first quarter of 2025, revenue of $6.53 million was reported, up 34% from the year-ago quarter. The company operates in a growing market, as the global mHealth market is expected to grow from USD 83.17 billion in 2023 to USD 249.05 billion by 2032 (CAGR: 13.1%, according to Grand View Research). This offers significant growth potential, especially in sectors such as telemedicine and preventive healthcare.

Products:

Its main products are the Hydreight app and the VSDHOne platform, which integrates telemedicine and e-commerce for healthcare providers. Services offered include infusion therapies, weight loss programs (e.g., GLP-1 therapies), genetic testing, and chronic disease management. Recently, a personalized genetic testing and wellness solution was launched on the VSDHOne platform.

Markets:

The company caters to patients in the U.S. who are looking for convenient, on-demand healthcare services, especially those who don't want to visit traditional medical facilities. The focus is on growing sectors such as telemedicine and preventive healthcare, with a particular focus on direct-to-consumer (DTC).

Why "Über für Nurse"?

The name "Hydreight" is an allusion to "Uber for Nurses". The company offers a platform that allows nurses and other healthcare professionals to work like Uber drivers – they can deliver services on-demand to the patient's location. This reflects the flexibility and on-demand nature of the service, similar to how Uber offers rides on demand.

Sales Trends:

• 2022: $3.276 million (GAAP)

• 2023: $11.51 million (GAAP)

• 2024: $16.04 million (GAAP), $22.32 million (adjusted)

• Q1 2025: $6.53 million (adjusted), +34% year-on-year

The company has shown consistent revenue growth, with a 39% increase in 2024 compared to 2023. Adjusted revenue for 2024 was $22.32 million, an increase of 31% compared to 2023.

Profitability:

• Adjusted EBITDA:

• 2023: -$1.384 million

• 2024: +$0.49 million

• Q1 2025: +$0.16 million

GAAP Net Loss:

• 2023: -$1.937 million

• 2024: -0.405 million USD

• Q1 2025: +$0.02 million (net income)

Hydreight has achieved positive Adjusted EBITDA in 2024 and the first quarter of 2025, indicating an improvement in profitability. The GAAP net loss was significantly reduced, and Q1 2025 showed a small profit.

Cash flow:

The company has generated positive cash flow from operating activities in 2024, indicating a strong operating performance. As of Q1. In 2025, the cash balance is $6.04 million.

Outlook – Strong growth through VSDHOne Virtual:

Hydreight's third and newest division, officially launched in the fourth quarter of 2024, is widely regarded as the company's most scalable and transformative initiative to date. This positions the company as a backend infrastructure provider for digital health brands that seek nationwide reach without having to deal with the complex regulatory environment of the U.S. healthcare system.

Instead of building their own infrastructure, brands are integrating Hydreight's compliant, doctor-led platform.

Hydreight takes care of all the complex back-end processes – from state medical compliance and telehealth logistics to electronic health records, pharmacy order fulfillment, and liability insurance – so customers can focus on marketing and customer experience.

Here's how it works. A digital health company enters into a SaaS contract with Hydreight, the price of which is based on the number of states it wants to operate in ($5000/month for all federal states).

Hydreight provides access to its network of doctors, EMR platform, and pharmacy services. Brands can add Hydreight's features to their websites. All medical monitoring, prescription making, patient safety and legal risks are handled by Hydreight.

Hydreight receives monthly SaaS fees. As in other industries, Hydreight achieves an average gross margin of 20% on prescription and treatment orders. Because onboarding is largely automated and most customers require minimal assistance once set up, margins can quickly increase as size increases.

This vertical market is seen as the linchpin of Hydreight's long-term strategy for several reasons. Unlike the mobile or brick-and-mortar vertical markets, which grow linearly with the addition of providers or clinics, the DTC market can onboard hundreds of brands with a relatively fixed cost. The digital health services market is expected to exceed $500 billion globally by 2030. With growing consumer demand for personalized, convenient care at home, Hydreight could be well-positioned to gain a share of it. Many of the services offered require ongoing monthly treatment, which creates natural recurring revenue.

According to management, the number of licenses for the VSDHOne platform is expected to increase sharply from the 3rd quarter of 2025, see chart.

Management has forecast approximately 1.3 million DTC orders for 2025, see chart.

If these sales figures are only approximated, the growth is huge. For my own models, I calculate with about 20% of the projected growth.

Skin in the Game - Shareholder Structure

The market capitalization is only about 66 million US $. As of July 2025, Hydreight has about 45 million shares outstanding. This is taken into account by a recent issue of 4.4 million shares as part of a LIFE offering in February 2025.

The recent issue of 4.4 million shares increased the total number of shares from approximately 40.6 million to 45 million. This is moderate dilution, but future capital raises could require further issuance of shares, which could further dilute existing shareholders.

Founders and executives such as CEO Shane Madden are closely associated with the company, indicating a strong commitment. Madden has served as CEO and founder of IV Hydreight Inc. since November 2022.

Risks

Investing in Hydreight Technologies involves several risks that should be taken into account:

• Regulatory risks: The company operates in the highly regulated healthcare sector. Non-compliance could lead to penalties or operational disruptions.

• Competition: The mHealth market is highly competitive, with established players such as Teladoc and Hims & Hers, as well as new start-ups.

• Dependence on health professionals: The business model depends on the acquisition and retention of nurses and doctors; a shortage of skilled workers could hinder growth.

• Economic conditions: A recession could reduce demand for non-essential health services, such as wellness programs.

• Technological risks: Disruptions or cyberattacks could affect operations as the platform relies on technology.

• Financial risks: Despite progress, the company is not yet GAAP profitable, and slow growth could jeopardize profitability.

• Dilution: Future capital raises could result in further dilution, especially if more shares are issued.

Opportunitiess

The key word here is scalability! Hydreight Technologies' scalable systems can grow without the need for major changes or investments. This facilitates problem-free explosive organic expansion.

Why does this opportunity exist?

Hydreight Technologies is a typical U-share:

· Unknown

· Unpopular, because too small

· Undervalued.

The demand for convenient, on-demand healthcare services is growing, especially after the COVID-19 pandemic, where many patients have realized the benefits of services delivered from home. Hydreight is benefiting from the growing telemedicine and mHealth industry, which is expected to expand to over USD 249 billion by 2032. The company has a unique positioning with its integrated platform and focus on mobile healthcare, which sets it apart from traditional providers.

There are no specific analyst ratings for Hydreight Technologies, probably due to its size and OTC listing. As far as I know, there are currently only isolated discussions on X/Twitter and there are not 4 analyses of the stock at https://www.joinyellowbrick.com/.

Catalysts

Potential catalysts for a rise in the stock price include:

• Upcoming results: The next quarterly results are scheduled for August 28, 2025. Strong results could have a positive impact on the stock price.

• Partnerships: Hydreight has recently partnered with Dr. Franklin Joseph for weight loss programs. Further partnerships could promote growth, e.g. with large healthcare providers or pharmacy chains.

• Product launches: New services such as genetic testing and advanced telehealth options could boost sales, especially through the expansion of the VSDHOne platform.

• Regulatory changes: Changes in the law that promote mobile healthcare could benefit the company, e.g. through facilitated licenses for mobile service providers.

• Institutional interest: An entry from institutional investors could increase liquidity and the share price, especially if large funds get in.

• M&A activity: Hydreight could be a target for larger healthcare groups, given its growth potential and market position.

Current price CAN$2.01.

My price target for the next 3 years is CAN$6.6 (+227%).

My basic idea when investing is to buy a stock cheaper than it is actually worth. I work with a "fair P/E ratio" (P/E ratio - price-earnings ratio), which is supposed to reflect the fair value of a stock. If a fair P/E ratio of 15 is calculated for a company and is currently trading on the stock exchange for a P/E ratio of 10, then it would be a cheap buy. The bigger the gap between fair and current P/E ratios, the cheaper I am in purchasing! From this "gap" I calculate the potential for future price gains, because sooner and unfortunately sometimes later, the stock market recognizes the "fair P/E ratio".

According to my calculations, the "fair P/E ratio" here is 23.1.

My investment style is a mixture of value/momentum investor. Based on the fundamental data (VALUE) and the price development of the last 52 weeks (MOMENTUM), the stock is currently one of my TOP 25 stocks. These are the stocks where I see the highest chances of strong price gains in the medium term (1-3 years). I also buy these values in my wikifolios, and FollowMyMoney.

What do you think about the stock?

Are you looking for support with investing money?

"Speculative investments are like a tennis match: the decisive factor is to concentrate fully on the next ace instead of being annoyed by the last double fault." A. Gerstenberger

Disclaimer / Haftungsausschluss

This text was partly created with AI applications.

All content is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell securities or other financial market instruments. Of course, I try to present the facts to the best of my knowledge and belief, but they can still be false in whole or in part.

Therefore, I do not accept any liability for investment decisions that you make on the basis of the information presented here.

Conflict of interest: At the time of publication, the author of this publication holds shares/securities of the securities/companies discussed here and intends to sell them depending on the market situation and could benefit in particular from increased trading liquidity. As a result, there is a concrete and clear conflict of interest.

1- Can u pl guide me about DTC, who is responsible if the customer sues them? How come a doctor in NURS, without even looking at the prescription and background history, can sign a GLP whose mixture is coined by some random seller? Who is taking responsibility for any mishap?

2- If a big compliance barrier is gone, why can't every random pharmacy, which can make, mix, and come up with the cheapest drug, sell it online, while a company's doctor is ready to sign the prescription blindly, even without noticing it? How come Dr Frank's website has time to look at every customer's details and prescribe them? I guess it's auto-happening. a patient fills the form online, and AI system just prescribe 1/10 durgs, went to pharmacy. no customization to patient. i am confused how it is all happening with out being a proper supervision from FDA

I guess i am missing something. your guidance would be appreciated.