I have recently invested in my wikifolios, at FollowMyMoney and/or my private accounts the following shares:

Plan Optik, $P4O, ISIN #DE000A0HGQS8

https://planoptik.com/de/investoren/startseite/

The company

The Plan Optik Group from Germany develops, produces and markets wafers for the smallest and microstructured parts made of glass, glass-silicon combinations and quartz for microsystems technology. In addition to wafers, the company also offers finished microstructured elements and components. Innovative products in the fields of health care (micro-dosing systems, micro-inhalers, lab-on-chips), automotive (sensors for driver assistance systems and engine control), aerospace (position and attitude sensors) and consumer electronics in particular are based on microstructured parts and wafers from the Plan Optik Group.

These microstructured elements are generally manufactured on the basis of wafers made of glass, glass-silicon combinations and quartz. The wafers are made from round discs with diameters of up to 30 centimeters. The wafers are thinned by Plan Optik during production and polished to a surface smoothness in the sub-nanometer range. Plan Optik then applies a wide variety of microstructures and surfaces to these wafers. The wafers are then cut into microstructured elements by Plan Optik itself or after further processing by the customer. During this dicing process, up to several thousand microstructured parts are produced from one wafer. Depending on the application and function, the parts are coated with copper, for example, or provided with structures such as micro-holes, micro-channels or vias.

The customers of the Plan Optik Group implement the microstructured elements in their series products. To this end, the companies of the Plan Optik Group form development partnerships with their customers in order to provide the parts to be implemented with the desired functions and shapes. Once development has been successfully completed, the companies deliver the customized parts directly to the customer's series production. The companies in the Plan Optik Group generally enter into long-term supply relationships with their customers. The start of production of new customer products or the sales growth of existing customer products generally leads to a long-term contribution to sales in the Plan Optik Group.

Financial data

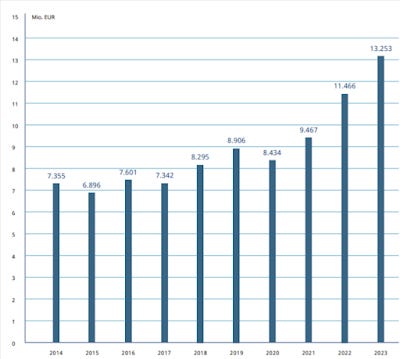

The sales trend is as follows.

Turnover has risen sharply since 2021. The financial data is as follows.

The company has 107 employees. The market capitalization is only around € 15 million. The net cash balance is around €1 million.

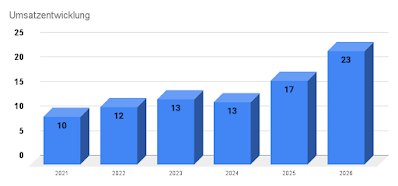

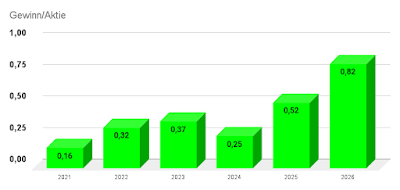

The price/earnings ratio for 2023 is only 9, which I consider to be very favorable for a growing high-tech stock. The year 2024 is expected to be a transition year in which revenues and earnings will decline. The decline is justified by customers reducing their inventories. From 2025, all key figures are expected to rise sharply again as new projects go live and the destocking ends.

The forecasts I have seen so far from the company management are rather conservative, in line with the good motto:

UNDER PROMISE, OVER DELIVER!

The chart

As you can see from the chart, Plan Optik is not a typical buy & hold share.

With the preliminary figures for 2022, the share price rose from € 3 to € 6 within 3 months. During this time, there was also a private placement of new shares at a price of € 3.75/share. At the Annual General Meeting, the expectations for 2023 were lowered and the share price fell to a low of € 2.82. The share price rose again with the preliminary annual figures for 2023.

The fundamental key figures (own calculations)

I expect sales to develop as follows:

Earnings per share developed as follows:

My basic idea when investing is to buy a share at a lower price than it is actually worth. I work with a "fair P/E ratio" (P/E ratio - price/earnings ratio), which should reflect the fair value of a share. If a fair P/E ratio of 15 is calculated for a company and it is currently trading on the stock exchange at a P/E ratio of 10, then it would be a good buy. The greater the gap between the fair P/E ratio and the current P/E ratio, the cheaper I am buying! I use this "gap" to calculate the potential for future price gains, as the stock market recognizes the "fair P/E ratio" sooner and unfortunately sometimes later.

According to my calculations, the "fair P/E ratio" here is 21.8.

My price target for the next 3 years is €11.2 (+240%)

My investment style is a mixture of value/momentum investor. Based on the fundamental data (VALUE) and the share price performance of the last 52 weeks (MOMENTUM), the share is currently one of my TOP 25 shares. These are the stocks where I see the highest chances of strong price gains in the medium term (1-3 years). I also buy these stocks in my wikifolios and at FollowMyMoney .

"Speculative investments are like a tennis match: the key is to concentrate fully on the next ace instead of getting annoyed about the last double fault." A. Gerstenberger

Disclaimer / Exclusion of liability

All content is for information purposes only and does not constitute investment advice or a solicitation to buy or sell securities or other financial market instruments. Naturally, I endeavor to present the facts to the best of my knowledge and belief, but they may still be partially or completely incorrect.

I therefore accept no liability whatsoever for investment decisions that you make on the basis of the information presented here.

Conflict of interest: At the time of publication, the author of this publication holds shares/securities in the stocks/companies discussed here and intends to sell them depending on the market situation and could benefit in particular from increased trading liquidity. This represents a concrete and clear conflict of interest.

Whats the ownership structure of the company? How much does management own?