I recently bought/increased the following stocks in my wikifolios, FollowMyMoney and/or my private accounts:

Immersion Corporation, $IMMR, ISIN # BMG3602E1084

https://www.immersion.com/

The Company:

Immersion Corporation is a developer and provider of haptics technologies. The Company develops, licenses and supports a range of software and intellectual property (IP) that fully address the user's sense of touch when operating digital devices. The Company offers licenses to its patented technology to its customers and provides its customers with software, related tools and technical support to integrate the Company's patented technology into its customers' products or to enhance the functionality of its patented technology.

Haptic technology is integrated into a variety of electronic devices, most notably game-based devices such as controllers. Haptic feedback is also used in cars, mobile devices and VR devices to enrich the customer experience and communicate through touch.

Immersion invests little and focuses more on maximizing its existing patent portfolio in the niche market for haptic technologies. The existing business has therefore delivered high cash flows in the past.

The investment in Barnes & Noble Education

"On June 10, 2024, the Company completed certain transactions with Barnes & Noble Education , Inc. (BNED) ("Barnes & Noble Education"). Under the terms of the transactions, the Company acquired 42% of all of the outstanding common stock of Barnes & Noble Education and control of Barnes & Noble Education through the five Immersion-appointed seats on its board of directors. The financial information contained in the press release includes Barnes & Noble Education's consolidated financial information for the period from June 10, 2024 through June 30, 2024. The Company owns approximately 11 million shares of Barnes & Noble Education common stock upon completion of this transaction."

The investment in Barnes & Noble Education was approximately USD 55 million. The current market value after only 4 months is approximately USD 115 million.

The quarterly figures

Sales have increased in recent quarters, boosted by the conclusion of a license agreement with Meta and the renewal or extension of license agreements by other customers such as Samsung and Nintendo.

However, another important growth driver was the investment in Barnes & Noble Education, which is now consolidated in Immersion's financial reports.

Revenues increased from USD 7 million to USD 99.4 million, see table.

Profit increased from USD 7 million to USD 28.8 million, see table.

Key figures/valuation

Immersion Corporation has a market capitalization of USD 273 million. The P/E ratio is only 3.2 according to Seeking Alpha, see table below. The dividend yield is 2.12%. I consider the valuation to be very favorable.

The "short rate" is high at 11.8%. If the turnaround at Barnes & Noble Education succeeds, there could be a "short squeeze". The short rate for Barnes & Noble Education is also high at 13.8%.

Insiders/insider buying

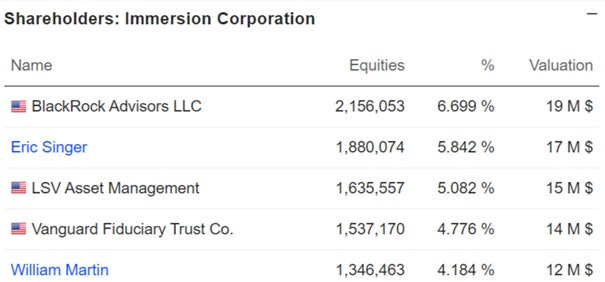

The CEO Eric Singer and the strategy director William Martin hold approx. 10% of the shares of Immersion Corporation, see table.

Both are now on the board of Barnes & Noble Education . Both have also bought shares there as insiders for over USD 1 million.

Eric Singer is the founder of VIEX Capital Advisors, which he founded in 2014. His investment strategy focuses on getting companies to focus on their strengths and maximize value for all shareholders through operational improvements and strategic mergers and acquisitions. In essence, Eric Singer is an activist investor who aims to achieve shareholder-friendly policies by gaining board seats and, if necessary, taking the helm as CEO. The latter is what happened with his investment in Immersion Corporation.

Eric Singer was appointed CEO and Chairman of the Board in 2023. In connection with this announcement, the company declared the approval of a share buyback program in the amount of USD 50.0 million and a special dividend of USD 0.10 per share. This allowed Eric Singer to immediately implement significant capital allocation guidelines to return cash to shareholders.

At the end of 2023, Immersion Corporation paid dividends totaling USD 7.4 million and repurchased 1,217,774 shares at an average price of USD 6.77 per share for a total of USD 8.2 million. During the 2023 financial year, the company returned a total of USD 15.6 million to shareholders and at the same time reduced the diluted number of shares outstanding by approx. 3.0%.

What else is important, why does this opportunity exist.

Immersion Corporation is a typical 4 x U stock:

- Unknown

- Unclear

- Unpopular

- Undervalued.

As far as I know, there are currently no discussions on Twitter and no analysts following the stock. There are no investor calls after the quarterly reports.

Possible catalyst

The next quarterly results for Barnes & Noble Education will be announced at the end of November. This is the most important quarter, as this quarter traditionally generates the highest sales. If Barnes & Noble Education achieves the hoped-for turnaround, Immersion Corporation's shares will also benefit. Not many people know the links. I assume that the story will then become better known.

My price target for the next 3 years is 70 (+724%). Current share price €8.5.

My basic idea when investing is to buy a share at a lower price than it is actually worth. I work with a "fair P/E ratio" (P/E ratio - price/earnings ratio), which should reflect the fair value of a share. If a fair P/E ratio of 15 is calculated for a company and it is currently trading on the stock exchange at a P/E ratio of 10, then it would be a good buy. The greater the gap between the fair P/E ratio and the current P/E ratio, the cheaper I am buying! I use this "gap" to calculate the potential for future price gains, as the stock market recognizes the "fair P/E ratio" sooner and unfortunately sometimes later.

According to my calculations, the "fair P/E ratio" here is around 22.

My investment style is a mixture of value/momentum investor. Based on the fundamental data (VALUE) and the share price performance of the last 52 weeks (MOMENTUM), the share is currently one of my TOP 25 shares. These are the stocks where I see the highest chances of strong price gains in the medium term (1-3 years). I also buy these stocks in my wikifolios and on FollowMyMoney .

Are you looking for support with investing money?

"Speculative investments are like a tennis match: the key is to concentrate fully on the next ace instead of getting annoyed about the last double fault." A. Gerstenberger

Disclaimer / Exclusion of liability

All content is for information purposes only and does not constitute investment advice or a solicitation to buy or sell securities or other financial market instruments. Naturally, I endeavor to present the facts to the best of my knowledge and belief, but they may still be partially or completely incorrect.

I therefore accept no liability whatsoever for investment decisions that you make on the basis of the information presented here.

Conflict of interest: At the time of publication, the author of this publication holds shares/securities in the stocks/companies discussed here and intends to sell them depending on the market situation and could benefit in particular from increased trading liquidity. This represents a concrete and clear conflict of interest.

🤔 Today is the day? $BNED (in which $IMMR has a big stake) reported preliminary results yesterday after the market closed. Net profit will increase by 70% to 90% year-on-year.

https://investor.bned.com/investor-relations/news-and-events/news/press-release-details/2024/Barnes--Noble-Education-Reports-Second-Quarter-Preliminary-Fiscal-Year-2025-Unaudited-Financial-Results/default.aspx