(•‿-) 1 euro is currently available for 37.8 cents 💄 NAV MPH Health Care + M1 Kliniken Status share buyback program

NAV - MPH Health Care

MPH Health Care is an investment company whose investments are reported as financial assets under the balance sheet item "Financial assets" and are measured at fair value through profit or loss as at the balance sheet date. The investments listed on the stock exchange are M1 Kliniken and CR Energy.

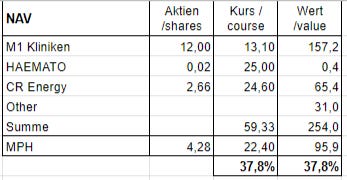

I use the following table to calculate the NAV - Net Asset Value:

Share prices as at 21.3.2024 - number of shares as at 30.06.2023 + sale of 1.5 million M1 clinics to Management Board members

Following the sale of 1.5 million M1 Kliniken shares to its Management Board, MPH Health Care still holds 12 million shares in M1 Kliniken. At a share price of € 13.1, the investment has a value of € 157.2 million.

MPH Health Care holds 2.66 million shares in CR EnergyM1 Kliniken. At a share price of € 24.6, the investment has a value of € 65.4 million.

I value other investments + cash at € 31 million.

The total of all investments therefore amounts to € 254.0 million.

MPH Health Care has 4.28 million shares. At a share price of € 22.4, the total market capitalization of MPH Health Care is only € 95.9 million. That is 37.8% of the NAV / net asset value.

In other words, I buy 1 euro for only 37.8 cents. 😉

The last dividend of € 2 was paid by MPH for 2018. MPH reached its record high of € 54.5 on July 3, 2018. Earnings per share amounted to € 8.6.

EBITDA at M1 Kliniken amounted to € 7.17 in 2018.

M1 Kliniken AG announced 16.2.2024 per ad hoc that private equity is interested in the beauty segment of M1 Kliniken. In similar transactions in the past, up to 30 times EBITDA was paid. Furthermore, an EBITDA of more than EUR 27 million was announced for M1 Kliniken in 2024.

M1 Kliniken AG announced a share buyback on April 20, 2023.

"The Management Board of M1 Kliniken AG has decided today to buy back up to 1,500,000 shares of the company in a total volume of up to EUR 10,800,000.00 (excluding incidental acquisition costs)."

The current status is as follows. So far, 482,027 (approx. 32% of the total volume of 1,500,000) shares worth approx. 4,964,151 (approx. 46% of the total volume of 10,800,000) have been bought back. This corresponds to approx. 23% of Xetra turnover. As far as I know, it is not allowed to buy more than 25%.

The share buy-back program should further boost the share price and protect it on the downside.

In addition, the board members of M1 Kliniken have bought their own shares worth > 15 million!

Disclaimer / Exclusion of liability

All content is for information purposes only and does not constitute investment advice or a solicitation to buy or sell securities or other financial market instruments. Naturally, I endeavor to present the facts to the best of my knowledge and belief, but they may still be partially or completely incorrect.

I therefore accept no liability whatsoever for investment decisions that you make on the basis of the information presented here.

Conflict of interest: At the time of publication, the author of this publication holds shares/securities in the stocks/companies discussed here and intends to sell them depending on the market situation and could benefit in particular from increased trading liquidity. This represents a concrete and clear conflict of interest.